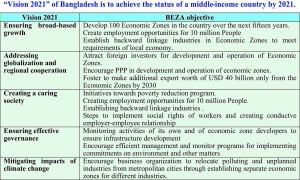

Establishing Economic Zones in Bangladesh is a historic initiative of the present government. Hon’ble Prime Minister of the People’s Republic of Bangladesh Sheikh Hasina has taken this commendable initiative for materializing the dream of the Father of the Nation of Bangabandhu Sheikh MujiburRahman to create “Sonar Bangla”. “Charter for Change” the election manifesto of the present government in 2008 proclaimed the “Vision 2021”,among others, the important one is to achieve middle income status by 2021, the 50th anniversary of our independence. The “Vision 2021” is nothing but theresurrection of the dream “Sonar Bangla”.

Bangladesh has demonstrated strong economic fundamentals with a consistent GDP growth rate of over 6 percent over the last 10 years. The projected GDP growth rate is 7% in 2015-16 and by this time growth rate of 7.1% has already been achieved and this will continue to grow in the years ahead.Out of 58 countries with a population of at least 20 million each, only 17, including Bangladesh, China, India and Sri Lanka, achieved an average GDP growth of six percent and more shows the World Bank’s analysis of growth performance of countries in a decade till 2014. Bangladesh graduated to a lower middle income nation from a low income one. Bangladesh’s per capita income now stands at $1466. And the government aims to treble it to over $4,000 by 2021.Over the last seven years, Bangladesh has set an example to the world by showing them how development andhigh inclusive growth is possible even in the face of natural and manmade heavy odds.

Bangladesh is striving hard to reach the milestone of middle-income status by 2021. The country needs foreign investment both money and technology, it would be achievable only if we have been able to create hassle-free environment for the investors in setting up industries and running their business. The essence is to reduce the cost of doing business in Bangladesh if we want to reach the middle-income country status.

In order to become a middle income country, Bangladesh Government established Bangladesh Economic Zones Authority (BEZA) through the promulgation of Bangladesh Economic Zones Act, 2010.Our Hon’ble Prime Minister instructed all concerned to strike a fine balance between protecting the environment and ensuring the development. Keeping this in view, all development works have been going on in the Economic Zones at a rapid pace without hampering the environment.

BEZA is committed to provide serviced land to the investors with all infrastructural and utility facilities. At this moment we are working with 74 economic zones out of which 12 are private economic zones. We have been working to establish 2 economic zones for the Japanese investors, 1 economic zone for the Chinese investors and 2 economic zones for the Indian investors on G to G basis.. BEZA’s vision is to become a sustainable development driving force and a world class investment promoters and service provider to ensure quality of life of the people. Its mission is to persistently create value for the investors by establishing attractive investment facilities in the economic zones through One Stop Service and competitive incentive packages. Its core values are Customer satisfaction,team working, free flow of information, participation and involvement, never stop learning, networking and effective Public Private Partnership.

Why Bangladesh is optimal destination of investment

- Consistent Economic Growth: Despite ups-and-downs in the global economy and the subsequent slump in growth, Bangldesh’s economy has been maintaining an impressive growth rate of more than 6% on average over the last 10-years.

- Industrious low-cost work force: Bangladesh offers a well-educated, highly adaptive and industrious workforce with economic wage level, proven by its remarkable success in RMG manufacturing and export. About 57.3% of the population is under 25, providing a youthful group for recruitment. In each year, around 2 million youth is entering in the job market.

- Low Cost Energy :Energy prices in Bangladesh are much cheaper compared to neighboring countries.

- Strategic location of Economic Zones: The locations of economic zones of the country have been chosen, based on regional connectivity, proximity to highways, access to ports, abundance of labor force, and backward linkage opportunities.

- Competitive Incentives to the Economic Zone developers and Units established in the Economic Zones : The government provided similar fiscal and financial incentives and benefits to industrial units as provided to the industrial units covered under Bangladesh Export Processing Zones Authority Act, 1980 and Bangladesh Private Export Processing Zone Act, 1996. Bangladesh offers the most liberal FDI regime in South Asia, allowing 100% foreign equity with unrestricted exit policy, remittance of royality, facilities, equity and dividend.

- Polices and reforms

w Continued reforms taking place embracing global best practices

w A positive attitude among policy makers towards undertaking reforms for business growth.

w A special high-level committee works for policy and regulatory improvement.

- Market Access

w Bangladesh has a large domestic market of nearby 160 million.

w Middle class (with purchasing power) is growing fast.

w Access to regional market of about 3.0 billion people through regional and bilateral integration in South Asia

w Bangladesh has preferred market access (global reach) to large developed markets

w ASEAN/East Asian investors can utilize Bangladesh as an export springboard to the world.

- According to doing business report 1014 Bangladesh stands in the south Asian region in the following positions

w The 2nd easiest place for Doing Business in the SA region

w 2nd easiest place in the region to do business

w 2nd in region on ‘starting a business’

w 1st in region on ‘protecting investors’

w 1st in region on ‘ease of paying tax’

Japan External Trade Organization (JETRO) in its 2014-15 survey mentionedthat Bangladesh has continued to be an attractive destination for Japanese companies to do business due to its lower production cost and labor wage compared to those of 19 countries in Asia and Oceania.In comparison to Japan, the cost of production in Bangladesh is less than half, (49.5 percent), while it is 81.9 percent in China, 73 percent in Vietnam and 80.6 percent in India.

Category of Economic Zones at a glance

- PPP Economic Zones-Established through public and private partnership (PPP) by local or foreign individuals, body or organizations;

- Private Economic Zones-Established individually or jointly by local, non-resident Bangladeshis of foreign investors, body, business organizations or groups;

- Government Economic Zones-Established and owned by the Government;

- Special Economic Zones-Established privately or by public private partnership or by the government initiative, for establishing any kind of specialized industry or commercial organization;

- G2G Economic Zones-Established upon initiative by the government of a foreign country of the Government of Bangladesh and/or in partnership between Government of Bangladesh and Government of a foreign country; and

- Economic Zones-Established in collaboration with and/or partnership between Government Authorities or Organizations.

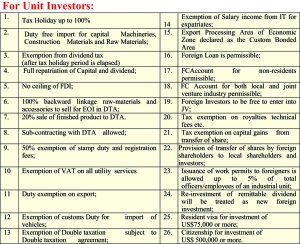

Incentive PackageOffered to the Investors

We all know that without attractive incentive package, no investors will come forward to invest in economic zones. Keeping this in mind and considering the incentive package offered by our competitor countries BEZA has been offering following multiple incentives to the developers as well as to the unit investors in the economic zones:-

For Developers

- Income Tax exemption in a block of 10 years out of 15 years.

- Exemption from custom and excise duties;

- Exemption of stamp duty and registration fees for land registration for the first time;

- Exemption of stamp duty and registration fees for land registration of loan/credit document;

- Exemption from dividend tax;

Conclusion

Throughout the world more than 100 countries are operating several thousand economic zones with huge diversity in terms of objectives, design and implementation. This poses challenges and opportunities to the policy makers and private sectors. In the developing world the trend of establishment of economic zones is increasing. It is important to learn from the past experience of different countries. During the process of zone development the framework should cover investment and job creation, ensuring dynamic benefits and sustainability. Successful zone programs require an environment of flexibility for most effective utilization of comparative advantage of the resources of a country. It is not enough to rely on fiscal incentives and low wage cost, rather it is crucial to facilitate more effective business environment to encourage firm-level competitiveness, local integration, innovation and social and environmental sustainability. For a business enabling atmosphere it will require proactive, flexible and creative approaches to address the potential macroeconomic constraints and unpredicted challenges.