Bangladesh is classified among the Next-Eleven emerging market economies, According to IMF, Bangladesh’s economy is the Second fastest growing major economy of 2016, with a growth rate of 7.1%.

Present context of Bangladesh is quite different from any time of the past. It has attracted the attention of the world in view of socio-economic, investment, business and industrial activities and successes. To utilize this opportunity more effectively, the Government of Bangladesh established Bangladesh Economic Zones Authority (BEZA) in November 2010 under the Bangladesh Economic Zones Act, 2010 to drive new Economic Zone regime. The authority is attached with the Prime Minister’s Office (PMO) and is mandated to establish, license, operate, and regulate economic zones in Bangladesh. Moreover, the authority is also committed to develop backward linkage industries, create employment opportunities and contribute to poverty reduction program.

Authority’s Vision for Industrial Development is in line with Government’s long-term outlook, defined in its Vision 2021, wherein, the Government of Bangladesh has set its development targets with the objectives of achieving middle-income country threshold by 2021, providing its citizens a higher standard of living, better access to education, improved social justice, and a more equitable socio-economic environment.

Industrialization is expected to play a pivotal role in achieving the above targets. Hence, government is committed to provide right policy intervention and framework to facilitate this growth and promote private participation in the economy’s growth.

BEZA’s Vision

BEZA aspires to become a sustainable development driving force and a world class investment promoter and service provider to ensure quality of life of the people.

BEZA’s Mission

BEZA’s mission is to persistently create value for the investors by establishing attractive investment facilities in the economic zones through One-Stop service and competitive incentive packages.

BEZA’s Objectives

BEZA wants to establish 100 Economic Zones on 75000 acres of land in the next 15 years with an employment generation for 10 million people.

BEZA’s Core Values

BEZA will strive to instill the following core values to reach and realize its vision and mission:

w Customer satisfaction;

w Team working;

w Free flow of information;

w Participation and involvement;

w Never stop learning;

w Networking; and

w Effective Public-Private Partnership.

BEZA’s Main Functions

- To identify and select sites for industrial or similar sectors;

- To acquire land for economic zones identified by own initiative or Public Private Partnership (PPP)and take possession of the acquired land on behalf of the Government;

- To appoint economic zone developer on competitive basis to develop, and manage the acquired land and different type of infrastructure thereof;

- To prepare infrastructure development plans of the Economic Zones for implementation and management of own establishment and submit it to the government;

- To allot or lease or rent of land, building or site, on competitive commercial basis in prescribed manner, to investors applied for establishing industrial units, businesses and service providers in economic zones for implementation and management of their establishment;

- To ensure infrastructure development of economic zones within specified period through monitoring of activities of its own and of economic zone developers;

- To create opportunities for employment through establishing backward linkage industries within or outside economic zones by promoting local and foreign investment including development of skilled labor force;

- To ensure efficient use of land in the light of clustering principles by dividing the land based on infrastructure and on availability of local resources to provide a conducive environment and facilities within economic zones;

- To encourage more efficient management and monitor programs for implementing commitments on environment and other matters

- To take steps to establish backward linkage industries in economic zones to meet the requirements of local economy;

- To encourage business organizations to relocate polluting and unplanned industries from metropolitan cities through establishing separate economic zones for different industries;

- To encourage public-private partnership in the development and operation of economic zones;

- To take necessary steps to implement social and economic commitments;

- To establish the due rights of workers, to ensure their welfare and to establish conducive relationships between owners and workers;

- To take appropriate steps to implement poverty reduction programs;

- To expedite implementation of industrial policy of the country by promoting planned industrialization of the thrust manufacturing and service sectors; and

- To convert the areas declared as economic zones into economic centers by developing industrial cities, agro-based industrial zones, trade zones and tourism zones through investment of banking sectors and to facilitate availability of skilled labor and efficient service provisions.

Trade Policy:

Bangladesh enjoys duty free and quota free access to many developed economies. It has signed Agreements with 28 countries to avoid double taxation.

Government of Bangladesh, under its Industrial Policy, 2016, has announced a large number of incentives to encourage Local and foreign investments. These are:

w Export oriented industries will be provided special benefits and venture capital;

w Foreign investors will be allowed to take working capital loan from local bank subject to existing rules and regulations;

w Incentives to private sector power generation companies (IPP, ISP) according to the Private Sector Power Generation Policy of Bangladesh; and

w Special incentives for using biomass, solar and windmill based power.

Recognizing policy initiatives in favor of economy’s potentials and need for employment generation in Bangladesh, Government of Bangladesh has accelerated expansion of industrial sector. Its continuous reforms and policy efforts have resulted in structural shift in the economy, with share of industries in GDP increasing from 21 percent in 1990 to 29 percent in 2013. Premised on improved industrial production, government’s target is to achieve 10 percent annual GDP growth by 2021; with industrial sector contributing around 37% in the total GDP.

The high growth agenda makes greater fund mobilization through private sector participation imperative. Hence, to deliver on its envisioned target Government of Bangladesh has identified Economic Zone development as a key ingredient for driving industrialization in the country.

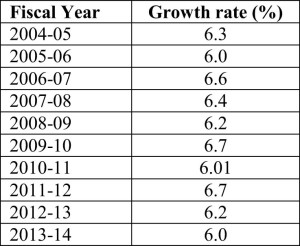

Bangladesh has demonstrated strong economic fundamentals with a consistent GDP growth rate of above 6.00 percent over last ten years.

This growth in GDP has been backed by increasing domestic market (with population increasing from 149.54 million in 1990 to 156.6 million in May 2015 and a significant growth in per capita income from USD 820 in 1990 to USD 1466 in 2016). In addition to domestic demand, low-cost labor with growing skills gives Bangladesh potential competitive advantage to attract labor-intensive industries and serve as a hub to cater export demands. Moreover, as estimated, the cost of doing business in its capital Dhaka is significantly lower than 28 major cities in Asia.

The investment fraternity Goldman Sachs has included the name of Bangladesh in its ‘Next 11’ countries list acknowledging the potentials of Bangladesh’s economy. Also the HSBC has been increasing its confidence in its economy’s trade potentials.

Bangladesh: Global Recognition

w Goldman Sachs

(Bangladesh among next-11 economics)

w JP Morgan (Frontier Five)

w S & P affirms

(Bangladesh’s rating stable for sixth straight year)

w Ranked 174 by Doing Business Report 2016 of World Bank

w Ranked 22nd in the A. T. Kearney Global Services Location Index, 2016

Vision 2021 of Bangladesh is to achieve the status of a Middle-income country by 2021

Ensuring broad-based growth

w Development of 100 Economic Zones in the country over the next fifteen years

w Creation of employment opportunities for 10 million People

w Establishment of backward linkage industries in Economic Zones to meet requirements of local economy

Addressing globalization and regional cooperation

w Attract foreign investors for development and operation of Economic Zones

w Encourage PPP in development and operation of Economic Zones

w Foster to make exports worth USD 40 billion from only the Economic Zones by 2030

Creating a caring society

w Initiatives towards poverty reduction program

w Establishing backward linkage industries

w Steps to implement social and economic commitments

w Establishing social rights of workers and creating conducive employer-employee relationship

Ensuing effective governance

w Monitoring of activities of economic zone developers to ensure business friendly infrastructure development

w Encouraging efficient management and monitoring of programs for implementing commitments on environment and other matters

Mitigating impacts of climate change

w Encourage business organizations to relocate polluting and unplanned industries from metropolitan cities to planned industrial area through establishing separate economic zones.

Category of Economic Zone at a glance

1) PPP Economic Zones-Established through public and private partnership (PPP) by local or foreign individuals, body or organizations:

2) Private Economic Zones-Established individually or jointly by local, non- resident Bangladeshis or foreign investors, body, business organizations or groups:

3) Government Economic Zones-Established and owned by the Government;

4) Special Economic Zones-Established privately or by public private partnership or by the Government initiative, for establishing any kind of specialized industry or commercial organization;

5) G2G Economic Zones-Established upon initiative by the government of a foreign country or the Government of Bangladesh and Government of a foreign country; and

6) Economic Zones-established in collaboration with and/or partnership between Government Authorities or Organizations.

Attractive Investment Opportunity Strategic Location

Sites for Economic Zones identified by BEZA for industrial development are strategically located in vicinity of the existing ports and airports. It supports not only in better logistics management but also in providing opportunity to leverage growing neighboring markets of China, India, Japan and other countries of ASEAN region.

Infrastructure Provision

Energy cost in Bangladesh is the lowest amongst the neighboring countries. Moreover, BEZA also intends to provide competitive energy prices to the investors. It is poised to provide continuous power to industrial players at incentivized rates, embarking the plots more competitive compared to any other offered sites.

Further, for Economic Zones, Government intends to provide in-built electricity generation to reduce dependence on national grid. It plans investment from domestic as well as foreign investors to set-up power plants to ensure regular electricity supply.

Incentive Package at a glance

For Developers

- Income Tax exemption for 10 years with reduced tax rate for more2 years;

- VAT Exemption on electricity;

- VAT Exemption on local purchase excluding petroleum products;

- Exemption from custom and excise duties;

- Exemption of stamp duty and registration fees for land registration for the first time;

- Exemption of stamp duty and registration fees for land registration of loan/credit document;

- Exemption from dividend tax.

For Unit Investors

- Tax Holiday for 3 years with reduced tax rate for another 7 years;

- Duty free import of Capital Machineries, Construction Materials and Raw Materials;

- Exemption from tax on dividend;

- Full repatriation of capital anddividend;

- No ceiling of FDI;

- 100% backward linkageraw-materials and accessories to sell for EOI in DTA;

- 20% sale of finished product to DTA;

- Sub-contracting with DTA allowed;

- 50% exemption of stamp duty andregistration fees;

- 80% exemption of VAT on all utilityservices;

- Duty exemption on export;

- Exemption of Customs Duty forimport of vehicles;

- Exemption of double taxation subject to Double taxationagreement;

- 50% exemption from Income Taxon Salary income for expatriates;

- Export Processing Area of Economic Zone declared as the Custom Bonded Area

- Foreign loan is permissible;

- FC Account for non-residents permissible;

- FC Account for both local and joint venture industrypermissible;

- Foreign investors to be free to enter into JV;

- Tax exemption on royalties, technical fees etc.;

- Tax exemption on capital gains from transfer of shares;

- Provision of transfer of shares by foreign shareholders to local shareholders and investors;

- Issuance of work permits to foreigners is allowed up to 5% of total officers/employees of an industrial unit;

- Re-investment of remittable dividend will be treated as new foreign investment;

- Resident visa for investment of US$ 75,000 or more; and

- Citizenship for investment of US$ 10,00,000 or more.

Conclusion

The establishment of economic zones in Bangladesh is a groundbreaking initiative of the present government. Honorable Prime Minister of the People’s Republic of Bangladesh Sheikh Hasina has taken this commendable initiative to fulfill the dream of the Father of the Nation Bangabandhu Sheikh Mujibur Rahman to build “Sonar Bangla”.

Bangladesh Economic Zones Authority (BEZA) invites national and foreign investors to invest in economic zones and share benefits of mutual growth prosperity. New Economic Zones could be a major driver of economic growth and job creation and could be a major factor in lifting Bangladesh to a middle-income country status by 2021.

BEZA is committed to facilitate development and operation of Economic Zones throughout the country. The main objective of BEZA is to act as a change agent for faster economic growth by creating investment friendly environment and attracting FDI. BEZA encourages private sector to establish Private Economic Zones. We are devoted to offer One-Stop Services and competitive incentive package to the investors.

So, BEZA is dedicated to attract Foreign Direct Investment (FDI), promote export and create employment through establishment of Economic Zones and making the zones as engine of economic growth of Bangladesh.